The transition to a low‐carbon, more sustainable, resource‐efficient and circular economy in line with the SDGs is key to ensuring long‐term competitiveness of the economy of the Union.

Regulation (EU) 2019/2088

L’acronimo ESG è utilizzato in ambito economico per indicare tutte le attività finanziarie che consentono di definire un investimento come responsabile, tenendo conto aspetti di natura ambientale (Environment), sociale (Social) e di governo aziendale (Governance).

Il 25 settembre 2015, l’Assemblea Generale delle Nazioni Unite, a cui hanno preso parte oltre 150 leader da tutto il mondo, ha adottato l’Agenda 2030 per lo Sviluppo Sostenibile, articolata in 17 obiettivi, conosciuti come Sustainable Development Goals (SDG), e 169 sotto-obiettivi.

Il Regolamento UE 2019/2088 affronta il tema dell'informativa sulla sostenibilità nel settore dei servizi finanziari.

Inoltre, le Linee Guida EBA (Autorità Bancaria Europea) contengono indicazioni in materia di concessione e monitoraggio dei prestiti.

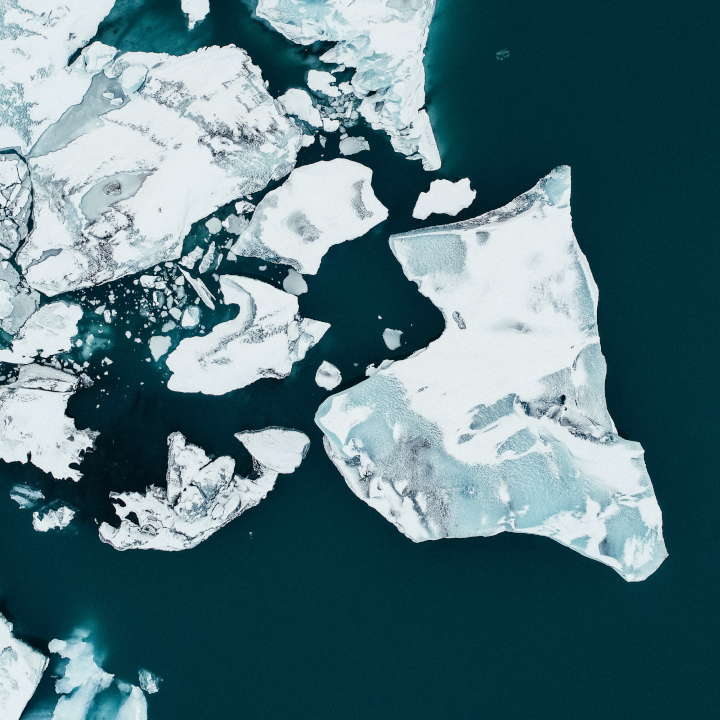

The Paris Agreement adopted under the United Nations Framework Convention on Climate Change [...] seeks to strengthen the response to climate change by making finance flows consistent with a pathway towards low greenhouse gas emissions and climate‐resilient development.

Making available financial products which pursue environmentally sustainable objectives is an effective way of channelling private investments into sustainable activities.

Regulations (EU) 2019/2088, 2020/852

This means that financial service providers are required to inform their customers on the sustainability of the products included in their portfolios.

Institutions should incorporate ESG factors and associated risks in their credit risk appetiteand risk management policies, credit risk policies and procedures, adopting a holistic approach.

EBA Guidelines

Alongside the growing sensitivity of public opinion and the demands of new legislation, the financial world also requires an assessment of ESG risks, as well as an increasingly objective and transparent information on the sustainable development of companies.

— ESG Cert

The name ESG Cert

The principles of environmental sustainability, people protection and enrichment and corporate governance models are key factors for any kind of assessment. This is why why want to be the entity of reference in the validation, verification and certification of innovative programmes in the field of sustainability, business continuity and regulatory compliance.